THE

ROTATING CREDIT ASSOCIATION:

A "MIDDLE RUNG" IN DEVELOPMENT

Clifford

Geertz

The University of Chicago

The building up of a variety of institutions, serving the purpose of promoting individual savings, and organizing them and making them fruitful to the saver and to the community, should be given a high priority in every development plan. To be effective, the institutions have to be adapted to different individual needs and possibilities and must fit into the community patterns; they must aim at encouraging planned and "goal-directed" savings. Even if, at least in the beginning, the financial results would not constitute more than a trickle of new capital disposal, the effects in rationalizing attitudes and mobilizing ambitions might be crucially important.

--Gunnar Myrdal, in

An International Economy (p. 360)

The necessity for a fundamental change on the part of the people of underdeveloped nations in their attitudes toward saving has been a recurrent theme in discussions of the developmental prospects of such nations. Unless aggregate national saving can be increased to cover, or at least approximately cover, the growth in investment a developmental program implies, persistent, run-away inflation will frustrate all efforts toward the realization of such a program. Neither large-scale international capital transfers nor improvements in the terms of trade can, in themselves, bring about domestic capital accumulation in the absence of effective efforts to raise the level of domestic saving, a hard fact of economic life summed up in V. K. R. V. Rao's aphorism that capital is made at home.1 In part, such savings can be realized by means of taxation programs, the compulsory sale of government securities, economies in government expenditure, and other fis cal measures; but in the long-run these financial mechanisms will not in themselves bring about the one change which is essential if development is to have a firm basis--a change in the propensity to save on the part of individual members of the population. Unless the basic savings habits of the people of a country can be altered, the prospects for sustained economic growth are dim indeed.

The reasons why the saving /income ratio of a particular country living above the subsistence level is what it is, rather than larger or smaller than it is, is dependent, as Henry Bruton has pointed out, on "the general pattern of mores and the social structure which govern all aspects of social behavior."2 Consequently, it is evident that an effort to change the ratio demands an attempt to change the general pattern of mores and social structure. The main efforts along these lines have so far been of two general sorts: (1) propaganda drives asking individuals to save through buying government securities, or (2) the setting up of Western-type savings institutions: banks, savings cooperatives, and the like.3 Neither of these efforts has been wholly ineffective, but both of them have tended to be disappointing: the first because deep-rooted customs yield very little to official sponsored exhortations to discard them in the interest of progress; and the second because the impersonality, complexity, and foreignness of the mode of operation of such "capitalist" institutions tends to make traditionalistic peasants, small traders, and civil servants suspicious of them. What seems to be needed, particularly in the early stages, is an institution which can combine local popular appeal with the sort of savings effects a developing economy demands; and institution which can act as an educational mechanism for a people moving from a static economy to a dynamic one, at the same time as it operates to bring about the restriction of increased consumption such a transformation implies.

It is the intent of this paper to describe and analyze one such institution found over a great part of that broad band of underdeveloped or semi-developed countries stretching from Japan on the East through Southeast Asia and India to Africa on the West: the so-called rotating credit association.4 The rotating credit association, which assumes a remarkably similar form over a very wide geographical area, although to be sure with local adaptations and variations, will be shown to be essentially a device by means of which traditionalistic forms of social relationship are mobilized so as to fulfill non-traditionalistic economic functions. It will be seen, in fact, to be an "intermediate" institution growing up within peasant social structure, to harmonize agrarian economic patterns with commercial ones, to act as a bridge between peasant and trader attitudes toward money and its uses. The rotating credit association is thus an institution of the sort Myrdal rightfully demands: one which fits into community patterns and yet aims at planned and "goal-directed" savings.

I shall begin with a brief description of the rotating credit association as it is found in Modjokuto, a town-village complex in Eastern Java, Indonesia, which I studied in 1953-54.5 The association is found in Modjokuto in its most elemental form, and the way in which it is integrated into the more general sociocultural pattern can, consequently, be quite explicitly demonstrated. Next, I shall review the general distribution and typical variations of the association in Asia and Africa, in an attempt to show more complex elaborations of the basic form, both in organization and in terms of its economic functioning. And finally, I shall say something about why this institution has arisen, the functions it fulfills, and the meaning it has for those who participate in it.

1. The Rotating Credit Association in Eastern Java

The basic principle upon which the rotating credit association is founded is everywhere the same: a lump sum fund composed of fixed contributions from each member of the association is distributed, at fixed intervals and as a whole, to each member of the association in turn. Thus, if there are ten members of the association, if the association meets weekly, and if the weekly contribution from each member is one dollar, then each week over a ten-week period a different member will receive ten dollars (i. e., counting his own contribution). If interest payments are calculated, by one mechanism or another, as part of the system, the numerical simplicity is destroyed, but the essential principle of rotating access to a continually reconstituted capital fund remains intact. Whether the fund is in kind or in cash; whether the order the members receive the fund is fixed by lot, by agreement, or by bidding; whether the time period over which the society runs is many years or a few weeks; whether the sums involved are minute or rather large; whether the members are few or many; and whether the association is composed of urban traders or rural peasants, of m en or women, the general structure of the institution is constant.

In Modjokuto, the rotating credit association is called an arisan--literally, "cooperative endeavor" or "mutual help." Its form is of the most elemental sort: interest is not calculated, rotation is determined by lot or by agreement, membership tends to be small, and a separate staff of officers does not exist. The members s imply come together and agree among themselves to contribute one or two rupiah every week or month, each one thus receiving ten or fifteen rupiah once during a ten- or fifteen-week or month cycle. Each person who draws the fund is responsible for holding the next meeting of the association in his home, and of providing food and coffee for other members. A meeting of an arisan is thus also a feast, a small gathering of friends, neighbors, and kin, and, particularly in the villages, is commonly viewed by its members less as an economic institution than a broadly social one whose main purpose the the strengthening of community solidarity. The primary attraction of the arisan, they say, is not the money you receive, but the creation of rukun (communal harmony) which occurs, the example of gotong rojong (mutual assistance) which is demonstrated.

Traditional Patterns of Cooperation and the Arisan in Rural Java

To the extent that it still exists, the traditional Javanese village is essentially a group of territorially integrated elementary families. Extended kin ties are of some importance, but the major unifying bonds are those of neighborhood, village, and village cluster. The very labor-intensive pattern of rice cultivation necessitates concrete mechanisms of interfamilial cooperation, as does, of course, the crowded, nucleated-village settlement pattern, and these mechanisms of cooperation are all geographically based. What has developed, consequently, is not so much a general spirit of cooperativeness--Javanese peasants tend, like many peasants, to be rather suspicious of groups larger than the immediate family--but a set of explicit and concrete practices of exchange of labor, of capital, and of consumption goods which operate in all aspects of life--in rice field cultivation, in house building, in irritation, in road repairing, in village policing, and in religious ritual. This sense for the need to support specific, carefully delineated social mechanisms which can mobilize labor, capital, and consumption resources scattered thinly among the very dense population, and concentrate them effectively at one point in space and time, is the central characteristic of the much-remarked, but poorly understood, "cooperativeness" of the Javanese peasant. Cooperation is founded on a very lively sense of the mutual value to the participants of such cooperation, not on a general ethic of the unity of all men or on an organic view of society which takes the group as primary and the individual as secondary.

This general model of rotating cooperation among families appears in all fields of traditional peasant life. The land tenure pattern is, for example, based on the myth that the contemporary occupants of the village are all descendants of its original founders. These founders are said to have cleared the forest from the village site and to have built the first rice terraces in a cooperative labor fashion, with the result that their descendants have all inherited equal use rights to the land. The land is, consequently, divided into equal plots and distributed among these descendants of the founders. In some villages the plots are actually rotated among these citizens every year or two; in others they remain with the same holder in perpetuity, though they cannot be alienated in any way and can be forfeited if the holder commits a serious crime or leaves the village. Since, in the original syssem, only such land-right holders could participate in the choosing of village leaders, political, economic, and--as the peasant-citizens are also family heads--kinship elements were fused.

Labor relations are, in the traditional pattern, organized in a similar fashion.6 The two major types of cooperative labor are "group work" and "exchange work." In group work, a whole neighborhood applies its labor to certain labor-intensive tasks: clearing a man's fields, erecting his house, etc. In such a pattern all the nearby neighbors are invited and are obligated to come, and the host provides a large feast at the close of the work. In "exchange work," several households work on each other's land in turn. Reciprocality is exact and specific, and usually work is returned within a short period of time.

Even the central religious ritual in the villages--the slametan--reflects this rotating communalism pattern. The slametan is a communal feast given in the home of one family for six or eight geographically contiguous families who are represented, as in political and economic contexts, by their male heads. Again, the feast may be prepared in the "group work" fashion, with the neighbors and (especially) relatives pitching in collectively, both in the cooking and in contributing the food. More commonly, however, the women of the host family prepare the feast, and the expectation is that over a period of time the giving of slametans will balance out among all the families of the neighborhood.

Today, the purely traditional pattern of life exists in full force only in the very isolated villages; in the Modjokuto area, the complex of intrusive factors summed up, somewhat inexactly, in the term "urbanization" has very noticeably weakened it. In addition to the "communal" land inherited from ancester-founders, there is now simple private property which may be sold outright for cash--though the tendency is still to sell it within the village. In addition to the traditional labor patterns, there is wage work--though this tends still to follow the obligations and expectations implicit in the older cooperative forms. And the contribution to the host at the slametan is now mainly in cash, rather than in kind--though close friends are still expected to be willing to help with the work. The Javanese village is thus moving fairly rapidly into the world-wide economy, and it is in terms of such an incipient stage of commercialization that the arisan seems best understood--it is a link between the largely unmonetized economy of the past and the largely monetized economy of the future.

In the villages, arisans are usually formed by a local group of three or four hoseholders through a common agreement, and other households are then invited to join. The order in which the fund is drawn by the various members is fixed, in most cases, by simple agreement: the originators of the arisan come before the later joiners, and the latter draw in terms of the order in which they signed up to participate. Usually a secretary to keep the records is elected; sometimes someone to call the people together to the weekly meetings at the home of the recipient of the previous week is also chosen. Sometimes, too, a very small sum is taken out of the fund and given to these "officials" as a token payment, but they have no other special role in the association. Twenty to thirty members is a typical size, one to five rupiah (i. e., a fund from twenty to one hundred fifty rupiah) the usual size of the contribution.7 At the end of the twenty- or thirty-week (or month) cycle, the arisan simply disbands, though it may soon be started up again with more or less the same personnel. Individuals may belong to several arisans at the same time, and they may hold multiple shares in a single arisan. Most members claim, actually, that the social, cooperative aspects of the associations--the small parties that accompany them and the sense of neighborliness they stimulate--are more important than the economic aspects: that they are closer to the slametan ritual pattern than, say, to the cooperative labor patterns, in the sense that their symbolic, expressive aspects have precedence over their technical, instrumental aspects. Nevertheless, as the cash needs of the peasantry grow ever and ever more intense, arisans become more and more important as strictly economic institutions, as mechanisms for mobilizing cash resources of essentially the same type as those which were, and are, used to mobilize land, labor, and consumption resources in traditional village society.8

Urban Arisans in Java

This tendency for arisans to become more and more specifically economic rather than diffusely social institutions becomes even more apparent among the inhabitants of urban compounds, or kampongs, within the town of Modjokuto. The kampong type of settlement, which is characteristic of town and city life everywhere in Java, is, essentially, a reinterpretation of the village pattern in terms of the denser, more heterogeneous, less organically integrated urban environment. Most of the well-to-do, fully urbanized members of the town elite live in stone houses along the streets, while the "lower class"--manual workers, petty craftsmen, small traders, or simply unemployed--live behind them within the blocks which the street grid outlines and the stone houses partially enclose. The land of the whole block is owned by one or two people--quite commonly, but not necessarily, one of the people in the stone houses facing the street. Small bamboo houses, of the same sort as common in villages, are placed haphazardly in crowded profusion on this block, often with very little space between them, so that the result is a rather fetid, unhealthy atmosphere. The people who live in these houses represent, then, a semi-urban, semi-rural proletariat, the members of which, though they have been forced to adopt many of the social, political, and economic patterns of the town, still cling to many of the values and beliefs of the village.

The arisan becomes, among these people, an extraordinarily popular institution, most particularly among the women, who hold the purse strings in any case. Almost every woman belongs to several; they are a constant topic of conversation and interest; and even children often form small ones--with ten or fifteen cent contributions - -among themselves. Further, though feasts are heId as in the villages, and the average size of the funds is only slightly larger, the arisans are seen much more in terms of their practical, instrumental importance, as mechanisms for the effective use of one's income, than is the case in the villages. One structural characteristic which points up this difference is the fact that almost all urban arisans decide on the order with which the individual draws the fund not by agreement but by lot. Thus the members are essentially gambling for the interest, a fact of which they are quite conscious. Nor is the sum involved insignificant. If the going monthly interest rate in the community is, say, 10 percent, then the man who "wins" first in a 12-member, ten-rupiah association which meets monthly gets an interest windfall (ignoring feast costs) of 66 rupiah, while the last man is out a theoretical 66 rupiah which he would have had if he had lent his 110 rupiah out on the open market in the same pattern.

The centrality of this factor in the minds of the members--in contrast to the relative unimportance of it in the villages (where interest-taking is rare in any case)--is shown by the gambling attitude kampong people take toward the arisan and the intense interest they have in it. They desire very much to win the lottery as early in the cycle as possible, are very disappointed each time they fail to win and very elated when finally they do. This anxiety to receive the fund early cannot be traced simply to fear of default by other members, for default is quite rare, mainly because the members are all fairly close acquaintances, and so would be deeply ashamed to evade their obligations, but also because the weekly or monthly contributions are small enough that most people can meet them somehow or other. Rather, it must be traced to an increased sensitivity to and understanding of the economic aspects of the rotating credit association, as against its symbolic, ritualistic aspects, or, more exactly, to an increasingly commercial rather than agrarian orientation in economic matters.

Arisan membership is praised in the kampongs not merely in terms of its positive effect on social solidarity--though this is stressed too--but even more enthusiastically as a good way to save money. If one has a little cash one will certainly soon spend it; but if one deposits it in an arisan, one can build it up into a sizeable sum. With such a sum one can make larger purchases than would otherwise be possible, say, of a bicycle or a new set of clothes. Or, one can hold a traditional ceremony, a wedding for one's daughter, a circumcision for one's son, both of which tend to be expensive. Or, one can lend the money out again at a high interest rate. More rarely, one can go into trading or craft work with it as capital. Of course, one can also simply "throw it away" on trivialities as if one had not joined the arisan in the first place. But kampong people tend to agree that the arisan improves the level of individual financial responsibility, for people are more careful and thoughtful in spending a large sum than in spending many small ones. Another positive factor of the arisan is that it acts as a form of insurance: if one is the victim of a sudden misfortune--say theft, or illness--one can always persuade the other members to allow one to taKe the pool out of turn, an as pect of the as sociation also im portant in the vi llages. The arisan is, then, an institution of growing importance in the wholly monetized economy of this culturally rather traditionalistic urban proletariat--at once a unifying ritual, an exciting game, an economically useful device, and a generally educational experience.

The arisan is also quite popular among the elite of the town, those who, for the most part, live in the stone houses along the streets. In this group it is almost always based on one or another of the dozens of sodalities, political parties, youth groups, labor unions, charitable associations, school societies, women's clubs, athletic associations, which have proliferated on the urban scene since the Revolution in 1945. This network of voluntary associations provides the main social structural context for society-wide leadership in post-revolutionary Indonesia. In Modjokuto the number of people active in these voluntary associations is only a small percentage of the total population, but the intensity of activity among these few is quite astounding. The number of committee meetings, conventions, demonstrations, charity drives, celebrations, and other such "modern" activities seems so great as to take up most of this group's free time. If there is not a school board meeting, there is a holiday celebration to be organized; if the women's club is not holding a charity bazaar, the labor union is meeting to discuss the latest government policies concerning railroad pensions. The velocity of activity is extraordinarily high, and as this group is, relatively speaking, small, the burden on them is rather great.

The arisan acts in this context, then, to support the solidarity not of the neighborhood group, but of the club, union, or party. The arisan is, in most cases, held after the usual business meeting, its explicit purpose being to attract individuals to the meetings, and to intensify the feeling of unity among them. If one is not present at the meeting one cannot win the fund, and club leaders say that clubs which have attached arisans get a much higher turnout than those which do not, for there is the added attraction that one might come home from the meeting with a sizeable bundle of cash. The purpose of club arisans, as one leader said, is to bring the members together in an informal, neighborlike setting, and so strengthen their friendship bonds and consequently the club. The older ties based on residential propinquity are thus being replaced by new ties of the same sort based on common club membership; there is a shift away from the dominantly territorial integration of the villages towards a form of integration in which ideological factors, the bases of the clubs, playa more important role. The arisan, the same leader said, is the "harmony" part of the club which makes the "business" part of the club, its central purpose, more effective. Also, however, the economic significance of the arisan is again more prominent than in the villages, and as the sums involved--funds may run as high as five hundred rupiah--are generally larger.

The final urban context in which the arisan is important is among the traders in the market.9 Market arisans are the most clearly and specifically economic of all. No meetings are actually held, but rather an agent is selected who tours the traders' stalls to collect the contributions and award the fund. Further, most market arisans are daily rather than weekly or monthly affairs, and they tend to be more or less permanent, cycling over and over again (though individual members may, of course, be replaced). The order of drawing is fixed. After the cycle has rotated several times, the sense of getting the fund early or late is obscured: one simply draws it every thirty days, etc.; so that the idea that some people have a more fortunate position in the cycle with respect to interest windfalls is also lost. The number of members in market arisans tends to be very large, reaching nearly 200 in some cases and only rarely being less than fifty. Funds are consequently rather large, even though individual contributions are small. Thus, one arisan with a one-rupiah contribution had 187 members and so a 187 rupiah fund.10 Sometimes, however, a smaller group of wealthier traders will form an even larger-scale arisan. For example, some 36 members of an Islamic trade cooperative contributed, at the same time, to a 5, a 10, and a 25 rupiah arisan every five days (the Javanese have a five-day market week), to yield a 180, a 360, and a 900 rupiah fund, which the recipients almost invariably used to buy textiles for resale. These arisans also never met, and one trader--smaller than the rest--had an almost full-time job simply keeping the records, making the collections, and distributing the fund. Here, then, the arisan has become an almost entirely economic institution, the diffuse "social harmony" element having dropped out almost entirely.

II. The Rotating Credit Association in Asia

The Javanese form of the rotating credit association, at least as it is found in Modjokuto, has, even within the market context, not developed to very complex levels of organization or of functioning. It remains a simple rotation pattern without interest calculations or elaboration of administrative superstructure. The available reports on similar associations in China, Japan, Indo-China, and West Africa,11 however, show a generally more complicated pattern. In Asia, the tendency is toward the development of complex methods of calculating interest payments and of distributing those payments among the members of the association. In Africa, the tendency is toward the development of more complex leadership patterns and more differentiated internal organization and, consequently, toward increasing administrative costs.

Swatow, South China

The simplest pattern reported for Asia is that given by Kulp, for a village in the Swatow area of South China.12 Here, a rotating credit association is always founded by an individual who needs a lump sum of cash for some particular purpose. The founder will contract, say, a fifty-dollar debt with ten people, and then pay it off by holding not ten, but eleven five-dollar feasts (the first one being that at which he receives his money), thus paying five dollars, or one feast, in interest. The ten creditors form a simple rotating system with five-dollar contributions and a fifty-dollar fund (including the contribution of the winner). In such a pattern, only the founder pays interest; his five dollars of "extra" feastgiving is theoretically divided as fifty cents among each of the other members over the whole cycle. This system is, obviously, very little different from the Javanese, and Kulp shows in detail how closely it is tied in with the traditional "familistic" orientation of the Chinese village.

Japan

Embree's description of the association in the Japanese peasant community, Suye Mura, where it is called a ko, introduces, however, a new element: namely, that of competitive bidding for the fund.13 Again, Suye Mura ko are typically instituted by a single individual in need of cash. If he needs, say, 60 yen, he will gather together a group of his friends and ask them to make up the loan. If there are twenty such contributors, for example, each will put up eight yen, and the borrower will then repay the loan in twenty ten-yen payments, usually making two such payments a year. Thus he pays forty yen in interest over a ten-year period. If the sum borrowed or the number of contributors is larger, the repayment may not be completed for as long as twenty years, individuals dying in the meanwhile being replaced by their heirs.

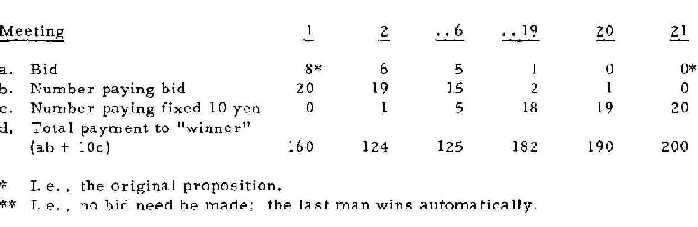

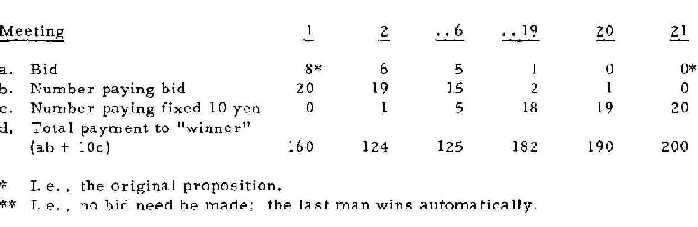

But the simple repayment pattern acts only as the framework for a more complex economic organization. At each of the twenty repayment meetings, the members each make a secret bid on a piece of paper. The lowest bidder receives the ten yen of the original debtor, plus the sum he has bid, say, six yen, from each of the other members of the ko. If this were the first meeting, this would amount to 10 plus 6 x 19, or 124 yen. Once having received the fund, an individual contributes an automatic ten yen at each meeting thereafter. Thus, the interest the second man would pay would be 8 (the original payment to the borrower) plus 10 x 18 minus 124, or 64 yen. The process continues through the whole cycle, though toward the end the bidding may be zero or even minus (in which case the bidder pays the members who still have not drawn the fund). Embree gives, in somewhat different form, the following ideal model of a 21 member ko of this size:

On the social side, however, the ko is almost identical to the arisan. Here, too, the man who won the fund at the previous meeting is responsible for providing his house and the necessary refreshments, and many ko are formed--they may be organized not only along neighborhood lines, but by age, sex, occupation, and the like--more for recreational than financial purposes.14 As almost everyone belongs to at least one ko, and most people belong to several, the ko acts as an important integrative institution in the society generally, and is deeply involved in the traditional Japanese value system emphasizing village cooperation. Embree stresses the fact that the ko is but one of several traditional forms of mutual aid common in Japanese villages, including exchange labor patterns, reciprocal gift giving, communal house raising and repairing, neighborly assistance in death, illness, and other personal crises, and so forth. Thus, as in rural Java, the rotating credit association is more than a simple economic institution: it is a mechanism strengthening the over-all solidarity of the village.

Shanghai, Central China

In the system reported by Fei, from a village near Shanghai in the lower Yangtze valley, interest calculation becomes even more complex.15 If, for example, the organizer of an association, which is called a hui, needs 140 dollars, he will gather 14 members to subscribe ten dollars each. The association will then meet twice a year for seven years, in the usual feasting pattern. At each meeting the organizer will repay ten dollars of capital and three dollars of interest. The man who "wins" at each meeting (he is chosen by lot) received, however, not 140 dollars, but half this, or seventy. At each succeeding meeting he will be a debtor and will repay five dollars of capital and one and one-half dollars of interest--i. e. , half of what the organizer pays. A man who has not yet drawn the fund--Fei calls him a depositor--makes a contribution determined by the following formula:

The total fund - [the organizer's contribution + (the number of donors x the debtor's contribution)], all divided by the number of depositors.

Suppose at the fifth meeting the total fund is 70 dollars, the organizer's subscription is 13 dollars (10 capital, plus 3 interest; this is a constant). Each of the four members who have already drawn the fund, i. e., the debtors, must pay 6. 5 dollars (5 capital, 1. 5 interest; also a constant, though of course the number of debtors increases one each meeting), and there are nine depositors, i. e., men who have not yet drawn the fund. The man who has just this time won makes up the fourteen members of the hui in addition to its organizer. The equation for a single depositor's contribution at this meeting is thus:

70 - [13 + (4 x 6.5)] or = 3.44 dollars.

9

This means that the 70-dollar fund is composed of a 13-dollar contribution by the organizer, a 26-dollar contribution by the four people who have already won the fund, and a 31-dollar contribution by the nine who have not yet won it.16

This system is sufficiently complex, Fei remarks, to be beyond the comprehension of the average villager, who has to invite the village head or some other notable to instruct him. Fei also emphasizes the manner in which a hui is built, in this family-centered society, around the kinship group: the nucleus of such an association is always a set of relatives. A man always approaches people who have consanguineal or affinal ties to him when he wishes to set up a hui: his father's brother, brother, sister's husband, mother's brother, wife's father, etc.; and these are under a heavy obligation to join or, if not, to find some of their own relatives to take their place. Thus a person with a large sphere of relatives has a better chance to organize a hui and so get financial support, than a man with a narrow sphere. Kin ties between members also, of course, reinforce the economic obligations involved, so that defaulting is rare, as it is in Japan. The usual purposes for starting such a society are ceremonial ones--to finance a wedding or a funeral--rather than productive ones, such as starting a business or buying a piece of land, the latter not being considered as proper ground for an appeal for a hui-type loan.

Peking, North China

Gamble's report on a semi-urban county in north China, just south of Peking, gives an example of a rotating credit association--of the auction variety--which fulfilled a more specifically economic, less diffusely social function.17 Of the eight members of the particular association studied intensively for whom the information is available, four used the fund they received for business expenses or ventures, seven loaned it out to others, and only three used it for family expenses. Among the "good points" of the association mentioned by members were included--in addition to the universal comment that they promote friendship--such distinctly non-traditional ideas as that they encourage thrift and that they provide investible funds of a low cost, while among the "bad points" were listed the fact that sometimes members evade their obligations, and that the feasts were too expensive and uneconomical. The fact that, in most cases, the costs of each feast were born equally by the members points in the same general direction: toward the conclusion that traditionalistic ties were of less importance here, or could be less relied upon, than in the other examples which have been reviewed.

Even more striking is the fact that the founder -of an association had to sign a written contract, in which all his obligations were spelled out in detail, and have it countersigned by two guarantors. Similarly, each member had to provide two guarantors before joining the association and had to sign a receipt for all funds received. But perhaps the most telling evidence of the essentially economic nature of the association in this area was the fact that Gamble's data for the whole ten-year cycle of an association he studied in detail (from 1917 to 1927), show a smooth linear increase in the amount received by each member as a percent of amount paid by him.18 This indicates that the members were figuring a set discount rate for the money, relatively independently of any immediate needs for it such as a wedding or funeral. As a result, the interest rate remained more or less constant, around 1.5% per month (a low rate). It seems clear that this association was relatively businesslike and uninfluenced by traditional needs.

Vietnam

But perhaps the most clearly economic in function of the Asian rotating credit associations so far reported is the ho of Vietnam.19 Traditional ho exist in the villages (ho means family, and, by extension, corporation or mutual association), operating according to the more broadly "social" pattern we have found elsewhere--the ties of friendship, kinship, and social status forming the integrative bonds for what is only secondarily or partly a specifically economic institution. As in Japan, some of them are even in kind--rice seedlings, etc. But in the urban areas of Vietnam, the rotating credit association begins to approach a fully "businesslike" organization, an embryonic corporation.

The urban ho are run by professional managers (who, it happens, are all women), who are not actually members of the association and usually run several at the same time on a purely economic basis.20 Each ho has a special firm name which must be notarized by the government; detailed books are kept of all transactions; and the obligations of all concerned are enforceable in the courts. In some of the more elaborate ho--organized among civil servants--one finds sealed bids, stamped receipts, acceptance of near monies such as promissory notes of Indian usurers, and a quite rational-legal set of statutes for governing the society, including default and bankruptcy procedures.

In general outline, the functioning of the ho is similar to that of the Chinese and Japanese auction-type associations, but there is a major difference in the role of the manager. Unlike the Japanese and Chinese cases, the manager does not set up the association in order to raise a personal loan, but as a straight business proposition. She takes one-third of the fund each time it is constituted, only two-thirds being distributed among the members, and she pays nothing in. Further, at the second meeting, the whole fund goes to her in full (i. e. , without bidding). This fund she uses personally to make loans to members which are paid back in small increments--with the going interest rate included--in much the same manner as in the association itself. Such loans from the manager are called "given ho," in contrast to the "bought ho" of the normal revolving fund.

On her side, the manager is responsible for providing the feast each meeting in her home, for advancing the fund to each winner, even if collections have not as yet been entirely completed or if members who have drawn the fund have defaulted, and for keeping the books. Thus, the manager is a small-scale professional banker at the center of a complex network of credit ties. As Nguyen comments,

"successful managers ... must know how to select their clientele, having it well balanced between those with resources and those needing loans in order to balance the offers and demands for money; they must also know how to arrange things so as to be able to have the meetings gay, very short, and sufficiently elegant but using up only a reasonable portion of the profits. There are some women who manage two, three, and up to five ho simultaneously, and know how to manipulate the funds of all without a hitch." 21

Another indication of the business-like nature of the ho is the fact that the gap between the open market interest rate and that of the rotating assocation is not so wide as in the traditional cases. The main advantage of the association over private money lending is not the difference in interest rate (though association rates are still a little lower), but in the fact that in private money lending "the money rests while the interest runs"--i. e., payments are not applied to the principle until current interest charges have been met in full--while in the association "the capital destroys;" i. e., part of each payment goes to discharge the loan, so that as long as one keeps up the relatively small payments he will sooner or later rid himself of the debt entirely. Genuine bondage to the association manager of the sort all to common to the private Indian or Chinese money lender evidently does not occur.

Pointing even more clearly in the same direction is the fact that each association usually has a core of several members who, well acquainted with the manager, merely make their payments regularly without coming to the meetings (they receive a money premium from the manager in exchange for their abandoned perquisites), the explicit understanding being that they will not receive the fund--which may grow as large as 2, 000 Indo-Chinese dollars (300 American)-until the last few meetings. Thus, they actually are "backers" of the manager, her source of finance in offering loans to others in the earlier part of the cycle. In some cases, evidently, the time of loans for every individual in the ho is contracted with the manager ahead of time, so that the association becom;;- more a matter of a rationalized savings institution managed by a skilled promoter than a simple expression of communal solidarity and mutual aid.

III. The Rotating Credit Association in Africa

The rotating credit association is also found in various parts of Negro Africa, most especially in the more commercially developed regions of West Africa, from where it evidently spread via the slave trade to the Caribbean, and perhaps to parts of the southern United States.22

The Bulu

A traditionalistic example of the rotating credit association in Africa, of about the same level of complexity as that of Modjokuto, is found among the Bulu of the French Cameroons.23 As in all the African cases, no interest is calculated, and bidding is not found. The pattern is largely confined to the salaried laborers and civil servants in this only very slightly monetized society, but these sometimes put almost the whole of their salary into the pool, depending on cultivation (or that of relatives) for their day-to-day subsistence. The fund, when received, tends to be used for such customary needs as a dowry, or to buy consumption goods such as a bicycle, or, much more rarely, to set up a son in a trade or craft. The order of drawing is strictly determined by traditional notions of status--based on kinship and age--and members are almost inevitably related to one another, at least to the point of being members of the same clan. The economic aspects of the association are thus completely embedded in tribal social structures.

The Nupe

Nadel's description of the dashi of the Nupe in central Nigeria, a rather more developed group than the Bulu, introduces the note which is characteristic of most of the African systems: the very strong role the leader of the group plays in determining its mode of operation.24 Among the Nupe, the head of the group decides the order in which the members will receive the fund. This man, called aptly enough the "king of the dashi," is usually a man of some reputation: for example, a well-known trader or the head of a craft guild. Especially able organizers are in heavy demand. As in Indo-China, the organizer does not himself participate in the association as a contributing/receiving member. He receives no payment, his only perquisite being that he is allowed to borrow from the fund occasionally for his own business needs, provided that the members agree and the original plan of the dashi is not disrupted. Also, he may receive gifts from a member who, without giving any "legitimate" reason for wanting to do so, wishes to collect at a certain time. A member who can, however, show a "real" need, from the traditional point of view (an illness, a funeral, a bride-price payment), need not pay a bribe to get his share when he wishes it; the head is obligated by custom to give it to him.

The Yoruba

The esusu of the Yoruba to the south and west of the Nupe follows an essentially similar pattern, except for the fact that the associations seem to reach a somewhat larger size than Nadel reports for the Nupe, running up to as many as 200 members, with cycles of four or five years.25 This larger size evidently necessitates a somewhat more formal organization. Larger esusu are divided into four or more subgroups, called "roads," which are numbered (1st, 2nd, 3rd, 4th, ... ), each with its own sub-headman under the over-all headman. Collection for the whole group must alternate among the roads as well as among individuals, giving the following sort of pattern for the order of receiving payment:

|

Road |

1st |

2nd |

3rd |

4th |

|

Order of payment: |

1 | 2 | 3 | 4 |

| 5 | 6 | etc. |

Here we have a somewhat more "bureaucratic" form of the system, for the head of the esusu may not even be personally acquainted with all its members; his relations are mainly with the subgroup heads. The members pay in and take out through the agency of the subgroup head, and it is he who determ ines the order of the distribution of the fund among members of the subgroup. In this slightly more impersonalized form of the association, defaulting by members and embezzlement by leaders is a more serious problem. If a member defaults after he has received the fund, every effort is made to force him to pay. The over-all head attempts to coerce the subgroup head, the subgroup head the member. As a last resort, the over-all head may take the matter to court. Some heads insist that the first round of contributions be kept as a reserve against possible defaults. Another technique used by the subgroup head is not to give the whole fund to one member at a time, but to split, say, the first payment between Mr. A and Mr. B, and then again split, say, the 13th between these two, thus maintaining an individual in a "depositor" position for a longer time.

The reverse problem, the probity of the heads, is also more prominent than it seems to be in the less developed cases. In larger esusu, a diviner may be called in to select the various heads in an effort to find ones who can be trusted not to abscond. The members keep track of their payments and receipts by cutting grooves into the walls of their huts, but this method is not certain enough, or the members do not have enough confidence in their own figures, to prevent heads from embezzling one or two rounds. This much of a cut for the head is considered more or less unavoidable and is chalked up to administrative costs, "but it is unlikely that the esusu head could take a third round for himself during the cycle without being caught."26

The Ibo

The most thorough and incisive report on the rotating credit association in Africa is that of Ardener on the Mba-Ise, an Ibo group also in Nigeria.27 The Mba-Ise area has no large towns or railheads, but population pressure is very heavy (1,000 per sq. mi.), leading on the one hand to a heavy outward migration, and on the other to land pressure of such an intensity that a man is fortunate if he can gain from 1/3 to 1/2 of his food requirements from farming. The result is that an elaborate trade economy is needed (based on the export of palm oil) to bring food in from the less dense areas to the north and south. "That the Mba-Ise has made the transition from a mainly agricultural to a predominantly trading economy successfully is due, to a large extent," Ardener argues, "to the growth and development of the [rotating credit association]."28

Here, the associations get even larger than those reported for the Yoruba. Ardener describes a one-shilling association, with 248 members of both sexes, divided into seven subsections, which meet every eight days (the Ibo have an eight-day week). Once every four Ibo weeks, shares are doubled to two shillings per person and two members receive a fund. Thus, each member pays five shillings in every thirty-two days and receives a fund when it comes his turn-once in four years and eight months--of £12 8s. Each member must have a senior man from his compound as a guarantor, who will agree, in writing, to continue the shares if the member defaults. These guarantees are kept by the association secretary and are upheld in court proceedings by the native bench. When a member receives the fund, he must sign or thumb-print a receipt for the money. Clearly, the size of the club, the length of the cycle, and the size of the fund combine to make this a fairly impressive example of long-term, "purposeful" saving--whatever the use to which the money is ultimately put.

The recipient of the fund has, however, certain overhead costs. First, he is required to supply six calabashes of palm wine for the other members. Secondly, he must contribute four shillings to the association loan fund. This fund, held by the association secretary, is constantly lent out in very small sums over short terms at the normal 100% interest rate. The fund increases rapidly--in the case at hand from £3 11s 0d to £17 19s 4.5d a year later, a 459% increase (!)--and is shared equally among the members at the end of the cycle, though some of it may be applied to a party for the whole association.

But the most important cost to the members is the 15-20% of the fund he must pay to the headman (or men) to get the fund. Here again, the headmen decide who shall get the fund at which time, and this is determined, in most cases, not on the basis of the headman's evaluation of the member's needs, but in terms of who offers him the highest bribes. Thus, the "interest" on the loans--about 1/5 of the going rate--goes here not to the lenders but to the headmen. It must be remembered, though, that the headmen are taking the risk of defaulters, in most cases, and are providing--with a membership of 250 or so--a genuine and necessary administrative service.

Nevertheless, there is a tendency for the associations to become top-heavy administratively. Associations tend to proliferate officers: councils are formed for general policy and money checkers appointed, as are food tasters and sanitary officials to judge the quality of the food at the feasts. In one one-shilling club with a £ 7 fund, there were two headmen, a secretary, a messenger, four chiefs, a sanitary man, and four food dividers. Each of these men drew money bribes and food payments, until the point arrived where the net fund was only £ 3, and the association dissolved in a fist fight. Evidently, breakdowns of associations due to the burgeoning of organization which raises administrative costs above a reasonable level are relatively common.

In any case, the rotating credit association is obviously of crucial importance in Mba-Ise society. In one subsection of a small lineage, Ardener found that six men paid an aggregate 90 shillings a month; the total fund to which they were contributing was £ 181 7s 6d. Only one of these six men received a regular wage of £2 a month, while the others were part-time traders, craftsmen, and, in all cases, farmers. Figures such as these must certainly damage theories about the intrinsic inability of peoples in "underdeveloped" areas to save.

Keta, Ghana

Thorough descriptions of the operation of rotating credit associations in African cities are, unfortunately, not yet available, but passing references to their existence and importance, both as specifically economic and broadly social institutions, have become increasingly numerous in recent urban studies in both West and East Africa.29 That, when investigated in detail, such urban forms may show some of the same sort of movement toward increased economic rationality that their counterparts in Asia show is indicated by the association Little has briefly described for Keta, a town in Ghana, where for the first time we find an association in which the amount each member contributes and receives is not firmly fixed by rule, but fluctuates according to individual speculative assessments.30 Composed of 400 members, most of them market women, the club raises a "loan" for one member at each weekly meeting. All the members present who have not yet taken the pot give as much money "as they feel they can afford," the amount they give being recorded in writing. The member receiving the collection as a loan is then given a list showing the amount of money contributed to it by each of the other members. As these various contributors in turn take the collection over the weeks, this former collector must contribute as much as the present collector contributed to his pot; i. e., if this week's collector contributed a shilling to my loan, I must contribute a shilling to his; if five shillings, then five shillings; while people who still have not yet collected continue to be free to give any amount they wish. All of this makes for a very much more calculating approach to the whole affair:

In a period of rising prices, those at the top of the list naturally have the advantage, but on the other hand, those who wait longer may receive more because the society's membership will in the meantime have increased. There is an element of chance in all this which adds spice to the normally dull business of saving, and this partly explains the society's popularity.31

But this increased sense for economic calculation does not, once more, imply the simple disappearance of the more diffusely social, solidarity-producing aspects of the association: when a member is sick, he is visited in the hospital; if he dies, his relatives are given £ 10 toward the cost of his funeral; and each week's loan raising begins with a round of community singing.

IV. The Rotating Credit Association and Economic Development

In a recent paper on the economic adaptation of oriental immigrants in Israel, S. N. Eisenstadt has attempted to demonstrate the manner in which "traditional value orientations" have been effective in supporting rather than hindering--at least in the early stages--such an adaptation to the highly rationalized Israeli economy.32 On the one hand, customary family and kinship ties, authority relations, and religious views have remained very strong among the new immigrants from such "underdeveloped areas" as Yemen, Iran, and North Africa; while on the other hand, these immigrants have made an increasingly successful adjustment to the developed economic setting through the mediation of the agricultural cooperative. Within the cooperatives it has proven possible to integrate traditional attitudes with modern functions in such a way that the former actually support the latter rather than hinder them, and the latter react back upon the former to alter them slowly. A form of symbiosis between the "traditional" social structure of the immigrants and the more "rational" one into which they have been suddenly projected has made possible the immigrants' adaptation to the new economic and political tasks with which they are faced, while at the same time minimizing the strain of transition and social transformation. The agricultural cooperative may thus be seen as an "intermediate" institution which links traditional motivations to modern functions, serving at the same time to transform those motivations toward a more rationalistic basis; it "facilitates the learning of new skills, patterns of behavior, and value orientations, and makes possible some changes in the structural principles in the general direction of modernization, without undermining the basic cohesion and solidarity of the group."33

The rotating credit association is, I would argue, a similar intermediate institution, a product of a shift from a traditionalistic agrarian society to an increasingly fluid commercial one, whether this shift be very slow or very rapid.34 It, too, mobilizes familiar motivations and applies them to unfamiliar purposes, while serving at the same time to reconstruct those motivations on a more flexible basis. The arisan, ko, hui, dashi, or esusu is essentially, then, an educational mechanism in terms of which peasants learn to be traders, not merely in the narrow occupational sense, but in the broad cultural sense; an institution which acts to change their whole value framework from one emphasizing particularistic, diffuse, affective, and ascriptive ties between individuals, to one emphasizing--within economic contexts--universalistic, affectively neutral, and achieved ties between them.35 The rotating credit association is thus a socializing mechanism, in that broad sense in which "socialization" refers not simply to the process by which the child learns to be an adult, but the learning of any new patterns of behavior which are of functional importance in society, even by adults.36 The theoretical as well as the practical interest of the association lies in its ability to organize traditional relationships in such a way that they are slowly but steadily transformed into non-traditional ones, as an institution whose functional significance is primarily to facilitate social and cultural change in respect to economic problems and processes.

In all the cases we have reviewed, the rotating credit association has been found associated with a lesser or greater penetration of an elaborated, and ultimately international, exchange economy into a primarily agrarian society. Such a penetration of commerce into a peasant society means that the society must, in the long run, change its whole form in such a way as to (1) set aside certain social contexts within which rational, economic calculation can legitimately be pursued; (2) distinguish these contexts from others within which it is morally reprehensible to so calculate; and (3) relate the two. This is essentially a process of social structural differentiation and reintegration. On the one hand, narrowly economic processes must be institutionally segregated from broadly social ones, and economic interests must be allowed to operate independently of non-economic constraints to a rather higher degree than formerly. On the other hand, these processes and interests must in some way be integrated with, or related to, the broader social framework--the more differentiated economic system must remain an integral part, a sub-system, of the total social system. This in turn implies that there must be a development of a "commercial ethic," a set of social values in terms of which the expectations and obligations within the economy itself can be stabilized and regulated, which ethic is, at the same time, but a "special case" of the general value system of the society as a whole, formulated with respect to economic functions.

In these terms, one can see the range of forms of the rotating credit association which have been reviewed, both in Modjokuto and in Asia and Africa generally, as representing, in an over-all way, a continuum ranging from more "traditiona listie" to more" rationally oriented" types. As one moves from the village arisan, the Japanese ko, or the Bulu example, toward the Indo-Chinese ho and the case Ardener reports for the Mba-Ise, or Little for Keta, one moves toward an increasingly formalistic, impersonal, specifically economic institution; a fact reflected in the declining importance of the ritualistic, solidarity-strengthening elements, in the increasing concern with the financial probity of members and leaders and the legal enforceability of obligations, and in the development of more complex patterns of organization and commercial calculation.

The degree to which, in any given case, the rotating credit association is an institution with explicitly economic aims and modes of operation is an index of the degree to which commercial motivations, attitudes, and values have replaced diffusely social motivations, attitudes, and values as controlling elements in the members I behavior within economic contexts generally, the degree to which they have learned to discriminate between economic and "non-economic" problems and processes and to act differentially with respect to them.

The rotating credit association as an intermediate institution reflects, then, two contrary forces. There is a movement toward an increased segregation of economic activities from non-economic ones, a freeing of them from traditional constraints; while at the same time, there is a directly contradictory attempt to maintain the dominance of the traditional values over those developing economic activities, to defend the integrity of the less differentiated pattern. It is these contrary forces that the association is able, at least in many cases, to balance in such a way that severe disturbances of social equilibrium are avoided, even in a situation of fairly rapid social change. It permits, in the favorable case, a coordinated pattern of change in which the extension of commercial behavior, the relaxation of traditional constraints in economic ma tters, and the development of a specific commercial ethic can go hand in hand, thus avoiding either a suffocation of new forms of economic activity by non-economic values, or an undermining of non-economic values by the sudden intrusion of morally unregulated market forces. The socialization process of the individual has been likened to a man climbing a ladder:

"As he reaches up with his hands to rungs not previously within his experience, he does not immediately let go of the lower rungs on which his feet have rested. The process is rather something like this: he reaches up to a new rung, grasps it tentatively, and only when he is rather sure of its location and solidity does he venture to pull himself up and let the lower foot finally leave the lowest rung on which he has been supporting himself. ... Essentially we are saying that such a process is not possible if the climber is in touch only with two adjacent rungs of the ladder; there must be at least three; otherwise the uncertainties inherent in securing his grip on the unfamiliar top one of the series will not allow him to let go of the bottom one; he must have a "middle" basis of security on which he feels he can rely."37

It is suggested here, then, that the rotating credit society is such a middle rung in the process of development from a largely agrarian peasant society to one in which trade plays an increasingly crucial role.

In the less developed cases--the village arisan, etc.--the hold of the traditional values remains strong, but commercial activities are "symbiotically" fitted into them in such a way that these values actually help support the new forms of behavior, rather than simply smothering them. The essential problem at this stage is that specific economic norms (and skills) have not yet been developed and fully internalized, with the result that there is a tendency for economic processes to be carried on, in large part, unrestrained by "human" considerations. The rotating credit association makes it possible to use customary patterns of cooperation, mutual help, and communal responsibility to regulate the emergent activities. The fact that the members of the association all have neighborhood, kinship, or other particularistic ties with one another acts to prevent fraud and evasion. The fact that the money is delivered immediately upon collection to the winner, so that no one has to be trusted to hold cash belonging to anyone else for any length of time reduces the likelihood of embezzlement. The feasting aspect softens the harshness of the economic calculation aspects and prevents them from undermining customary ties. The form thus combines an activity functional to a commercial economy--the concentration of monetized resources in larger units--with a maintenance of traditional moral values.

But this pattern is obviously limited in the scale and complexity of commercial activity which it can support. It is confined to small numbers and simple forms of organization. Thus, in the more developed cases, the traditional elements weaken and the stress comes to be placed on devising legal and economic mechanisms of normative regulation--contracts, record-keeping, professional managers, stable discriminations between debtor and creditor roles, bureaucratic organization, and the like. The rotating credit association becomes more and more like a specifically economic institution, a "firm," with its own pattern of value integration. In this sense, the form is, perhaps, self-liquidating, being replaced ultimately by banks, cooperatives, and other economically more rational types of credit instituions. But these latter can only function when the differentiation of a specific economic pattern of norms has occurred--when courts will enforce contracts, when managers worry about their business reputations and keep honest books, and when investors feel safe in giving cash resources to debtors to whom they are not related. Cultural change of this sort takes place, however, in steps rather than all at once, and in the intermediary stages the association fulfills a valuable function in organizing traditional and rational economic attitudes in such a way that the process continues rather than stultifies or breaks down into anomie.

It seems likely, too, that the rotating credit association is merely one of a whole family of such intermediate "socializing" institutions which spring up in societies undergoing social and cultural change, not only in the economic, but in the political, religious, stratificatory, familial, and other aspects of the social system as well. The building of "middle rungs" between traditional society and more modern forms of social organization seems to be a characteristic activity of people caught up in the processes of social transformation. As a group, this fam ily of ins ti tutions should be, cons equently, of particular inte rest for students of social and cultural development, highlighting, as they do, some of the central tensions involved in such development and the sorts of mechanisms by means of which those tensions are resolved.

Notes (converted from foot- to end-notes)

1. Quoted in Myrdal, An International Economy (New York, 1956), p. 273.

2. "A Survey of Recent Contributions to the Theory of Economic Growth," unpublished paper, Center for International Studies, Mas sachusetts Institute of Technology, April 1956.

3. There have also been, of course, efforts at "direct saving" through the employment of surplus labor on capital-creating projects. Though important, there is an obvious limit to the effectiveness of this device, especially in libertarian societies.

4. Actually, many terms are used in the literature for this single type of institution: contribution clubs, slates, mutual lending societies, pooling clubs, thrift groups, friendly societies, etc.

5. The field work period ran from May 1953 until September 1954, and was undertaken as part of a group project of seven anthropologists and sociologists sponsored by the Center for International Studies of the Massachusetts Institute of Technology. I wish to express gratitude to Alice Dewey, Robert Jay, and the late Donald Fagg for contributing some of the data used in the paper. The writing of the paper has been made possible by a grant from the Ellis L. Phillips Foundation.

6. For a review of rural land tenure and labor relations patterns, see R. Jay, Village Life in Modjokuto (New York: The Free Press of Glencoe, in press).

7. One rupiah equalled about 10 dollar cents at the official rate, and about three dollar cents on the open market, in 1953-54.

8. A description of the operation of the rotating credit association in another region of rural Java, that of a western fruit-growing village near Djakarta, where it is called paketan (probably from pakat, "to agree upon"), shows a pattern essentially the same as that of the Modjokuto area (S. Stanley, "Paketan and Selamatan in an Indonesian Fruit-Growing Village," paper delivered at the annual meeting of the American Anthropological Association, Minneapolis, 1960). In this village there are two types of associations: paketan daging and paketan kawinan. In the paketan daging (daging, "meat"), the aim is to purchase collectively a carabao for slaughter to celebrate an Islamic holiday. Of the pool, 150 rupiah is donated by the "winner" (order is fixed by general agreement) toward the purchase of the carabao, the remainder being kept for personal use in the ordinary fashion. In the paketan kawinan (kawinan, "marriage ceremony"), meetings are held only irregularly, occuring only when a member has a ceremonial need--an offspring's wedding, circumcision, etc.--which he uses the pool to finance. Such associations are very long-term affairs, with positions being inherited as members die. Stanley reports that the rotating credit association is one of the major integrative forces in this otherwise fairly loosely integrated village.

9. For a description of the market in Modjokuto, see Alice Dewey, The Javanese Market (New York: The Free Press of Glencoe, in press).

10. Ibid.

11. The existence of rotating credit associations has been mentioned in passing, but not thoroughly described, for parts of India--Madras, for example--as well. See C. Notteboom, "Assistance Economique Mutuelle SystematisÈe dans L'Asie du Sud et de L'est," in Orientalia Nederlandica (Leiden, 1948), pp. 423-30.

12. D. H. Kulp, Country Life in South China, Vol. I, Phenix Village, Kwantung, China (New York, 1925), pp. 190-96.

13. John Embree, Suye Mura (London: Kegan Paul, 1946). Ko are, Embree reports, very old in Japan. A document mentioning them is found as early as 1275.

14. The "insurance" element is prominent again, too. For example, a number of silk growers who had experienced several failures formed a ko in order to hedge against future failures.

15. Fei Hsiao-T'ung, Peasant Life in China (New York, 1946), pp. 267-74.

16. As a matter of fact, the actual calculation is, for various reasons, a great deal more complicated than this. For a full numerical example of a hui, see ibid., pp. 271-72.

17. S. D. Gamble, Ting Hsein: A North China Rural Community (New York: Institute of Pacific Relations, 1954), pp. 260-71. See also his "A Chinese Mutual Savings Society," Far Eastern Ouarterly, IV (1944), 41-52.

18. It ran from a 51.6% low at the second meeting after the formation, to a 207.6% high at the thirtieth, or last, meeting.

19. Nguyen Van Vinh, "Savings and Mutual Lending Societies (Ho)," Yale Southeast Asia Studies, mimeographed, 1949.

20. Nguyen does note that "some ladies hold the ho not in order to do business, but to receive friends at their home, to show their well-kept homes, to demonstrate the talents of their daughters, sisters, sisters-in-law, or nieces of marriageable age; or to make people talk about their famoua pastries or of the excellent cooking done in their homes, or maybe even to boast of the rather innocent talent which consists of delicately folding over the betel leaves of a beautiful yellow-green shade or to be able to bring out the shade of rose-gray in the meat of sliced areca nuts, to perfume their tea, etc." But most women, he says, simply make a lucrative trade of it, and that there are in fact, some, "like the dubious bankers of Europe, who are able through adroit approach to draw in the resources of honest housewives and who, one fine morning, depart without having invited their clients to a going-away party and without leaving behind their forwarding address."

21. Op. cit.

22. The new world cases are described in M. Herskovits, Trinidad Village (New York, 1957), pp. 76-77; and M. F. Katzin, "'Partners,' An Informal Savings Institution in Jamaica," Social and Economic Studies, VIII (1958), 436-40. Katzin says the association is the most important single source of capital for petty traders in the Kingston area, but that minor government officials, domestic servants, and wage workers also form them; and she quotes Dr. Bernice Kaplan as reporting the existence of associations among American Indians in Peru. In West Africa, the form has been reported from Nigeria, the Ivory Coast, Ghana, and Sierra Leone; elsewhere in Africa from the Congo, the Cameroons, Uganda, and the Union of South Africa (see I. M. Wallerstein, The Emergence of Two West African Nations: Ghana and the Ivory Coast, Ph. D. thesis, Columbia University, 1959, pp. 170-71).

23. G. Horner, personal communication.

24. S. Nadel, Black Byzantium (London, 1942), pp. 371-73.

25. W. Bascom, "The Esusu: A Credit Institution of the Yoruba," Journal of the Royal Anthropological Institute of Great Britain and Ireland, LXXXII, Part I (1952), 63-70. Bascom notes that all the evidence points to the esusu being not a recent borrowing or innovation, but an ancient institution among the Yoruba.

26. Bascom, op. cit.

27. S. Ardener, "The Social and Economic Significance of the Contribution Club among a Section of the Southern lbo," Annual Conference, West African Institute of Social and Economic Research, Sociology Section, (Ibadan, 1953), pp. 128-42.

28. Ibid.

29.

E. g., M. Banton, West African City (London, 1957), pp. 187-88-->Freetown,

Sierra Leone;

C. and R. Sofer, Jinja Transformed, East African Studies No.4

(Kampala, 1955), p. 108-->Jinja, Uganda;

and A. Southall and P. Gutkind,

Townsmen in the Making, East African Studies No.9 (Kampala, 1956), pp.

162-63-->Kampala, Uganda.

30. K. Little, "The Role of Voluntary Associations in West African Urbanization," American Anthropologist, LIX, 579-96. This association is actually but a local branch of a highly organized national association which has its headquarters in Accra, the capital.

31. Little, op. cit.

32. S. N. Eisenstadt, "Sociological Aspects of the Economic Adaptation of Oriental Immigrants in Israel: A Case Study in the Problem of Modernization," Economic Development and Cultural Change, IV (April 1956), 269-78.

33. Eisenstadt, op. cit. I have altered the tenses.

34. Arguing, loosely, that the rotating credit association is a product of a changing society does not mean that I think it arose independently out of a local configuration of forces in each case. Its presence may be due in most cases to diffusion, perhaps in all cases but one. But, as has often been pointed out, diffusion analyses really contribute rather little to the understanding of social functioning in themselves. For example, the absence of the auction pattern of the association among the Javanese in Modjokuto can hardly be attributed to a simple lack of knowledge of it, for the commercially more sophisticated Chinese in the same town, from whom the Javanese have borrowed many other traits, practice it. Certainly, some assumption about "functional fit" and differential levels of economic development must be introduced to account for the fact that this auction pattern has not diffused "across the street," so to speak.

35. For a full discussion of these terms, see T. Parsons, Social System (Glencoe: The Free Press, 1951), pp. 58 ff.

36. "The term socialization in its current usage in the literature refers primarily to the process of child development. This is in fact a crudally important case of the operation of what are here called mechanisms of socialization, but it should be clear that the term is here used in a broader sense than the current one to designate the learning of any orientations of functional significance to the operation of a system of complementary role-expectations. In this sense, socialization, like learning, goes on throughout life. The case of the development of the child is only the most dramatic because he has so far to go." Ibid., pp. 207-8.

37. T. Parsons and R. F. Bales, Family, Socialization, and Interaction Process (Glencoe, 1955), p. 377.

The rotating credit association: a ëmiddle rungí in development, in: Economic Development and Cultural Change, Vol. 10, No. 3 (Apr., 1962), 241-263.

online source: http://www.jstor.org

JSTOR's Terms and Conditions of Use provides, in part, that unless you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you may use content in the JSTOR archive only for your personal, non-commercial use.

Economic Development and Cultural Change is currently published by The University of Chicago Press. Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at http://www.jstor.org/journals/ucpress.html.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed page of such transmission.

Using this text is also subject to the general HyperGeertz-Copyright-regulations based on Austrian copyright-law (2001), which - in short - allow a personal, nonprofit & educational (all must apply) use of material stored in data bases, including a restricted redistribution of such material, if this is also for nonprofit purposes and restricted to a specific scientific community (both must apply), and if full and accurate attribution to the author, original source and date of publication, web location(s) or originating list(s) is given ("fair-use-restriction"). Any other use transgressing this restriction is subject to a direct agreement between a subsequent user and the holder of the original copyright(s) as indicated by the source(s). HyperGeertz@WorldCatalogue cannot be held responsible for any neglection of these regulations and will impose such a responsibility on any unlawful user.

Each copy of any part of a transmission of a HyperGeertz-Text must therefore contain this same copyright notice as it appears on the screen or printed page of such transmission, including any specific copyright notice as indicated above by the original copyright holder and/ or the previous online source(s).